Gold Price Analysis: XAU/USD bulls eye 21-DMA amid falling Treasury yields, ahead of US data

- Gold advances amid a retreat in the Treasury yields, risk-off mood.

- 21-DMA would be a tough nut to crack for the XAU bulls.

- RSI remains bearish, suggesting that the upside appears limited.

Gold (XAU/USD) is posting small gains while advancing towards the $1740 level, as a cautious market mood underpins the traditional safe-haven.

The sentiment remains tepid amid covid vaccine concerns and pre-FOMC meeting cautious trading. Meanwhile, the 1% drop in the US Treasury yields across the curve also benefits the non-yielding gold.

However, if the risk-aversion deepens in the session ahead, the US dollar could witness resurgent haven demand, which will likely cap the recovery gains in the bright metal.

Gold’s fate hinges on the Fed outcome due to be announced on Wednesday. In the meantime, the US Retail Sales data could provide fresh trading impetus.

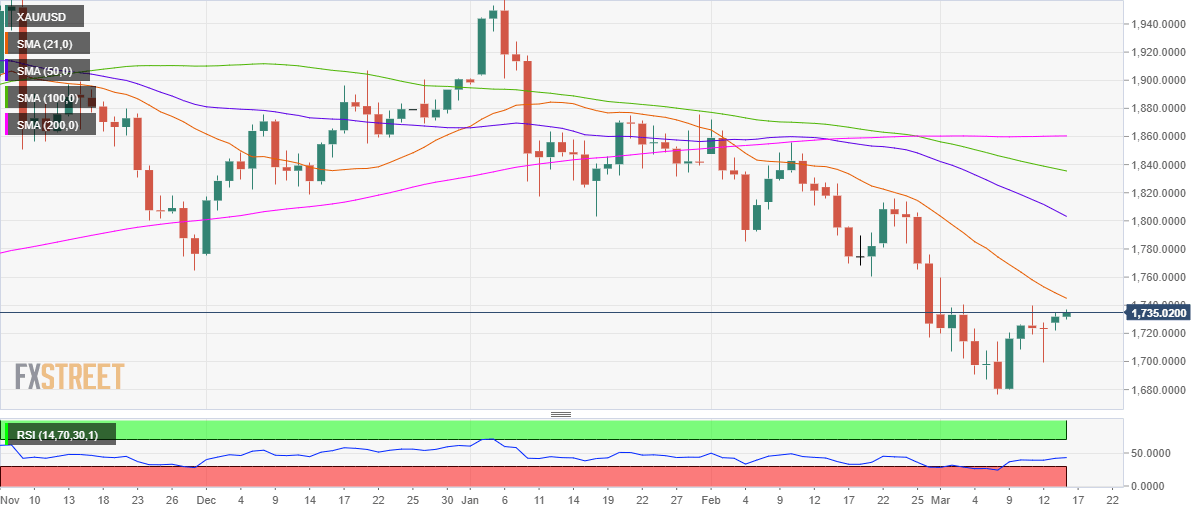

From a near-term technical perspective, gold’s daily chart shows that the price is heading towards the bearish 21-daily moving average (DMA) at $1745.

An hourly candlestick closing above that level is needed to unleash the additional upside, with the March 1 high at $1760 back on the XAU buyers’ radars.

The 14-day Relative Strength Index (RSI) inches higher at 43.02 but remains well below the midline, suggesting that there is limited scope for the upside and the sellers could likely regain control.

To the downside, Monday’s low at $1722 could be tested, below which the $1700 mark would limit further declines.

Gold Price Chart: Daily

Gold: Additional levels