提供最佳价差和条件

关于平台

关于平台

Net AUD short positions dropped last week but remain in negative territory despite the relative strength of the AUD on the spot market.

China/Australian tensions and the RBA’s QE policy could be tempering the attraction of the AUD.

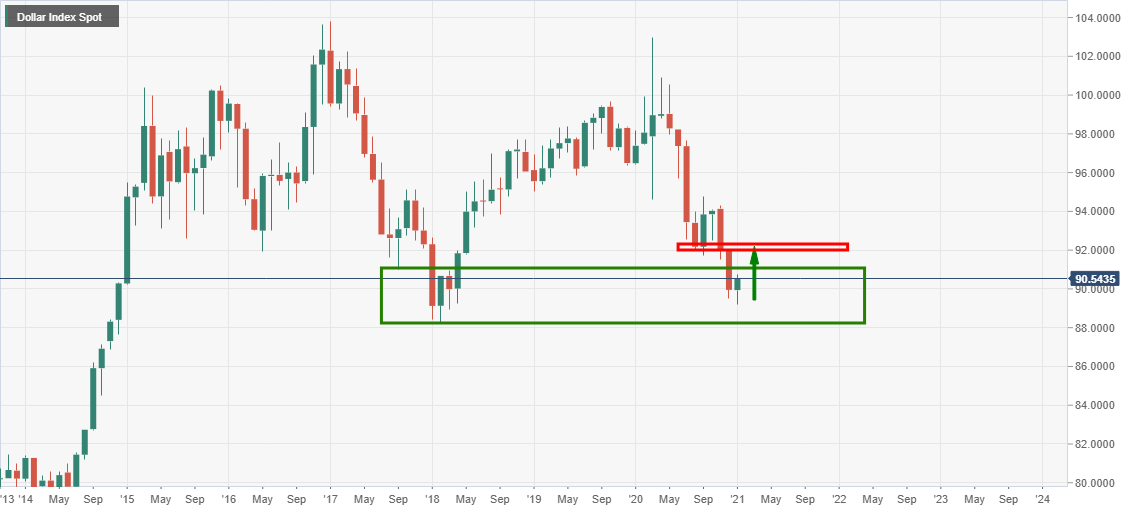

However, it is really a US dollar and yields story out there and the following is a top-down analysis that offers a bearish bias for the Aussie.

As illustrated, the greenback has plenty of room to rally if it is going to test prior resistance.

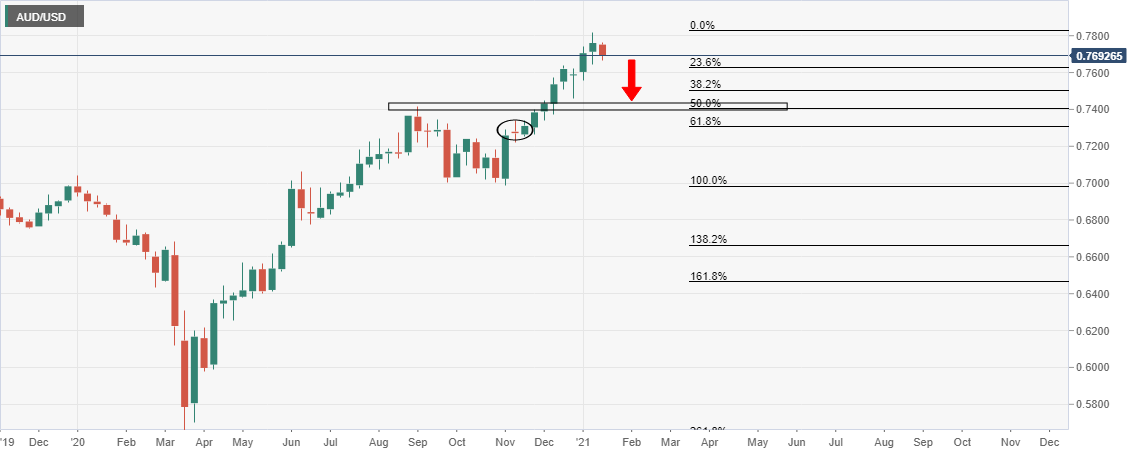

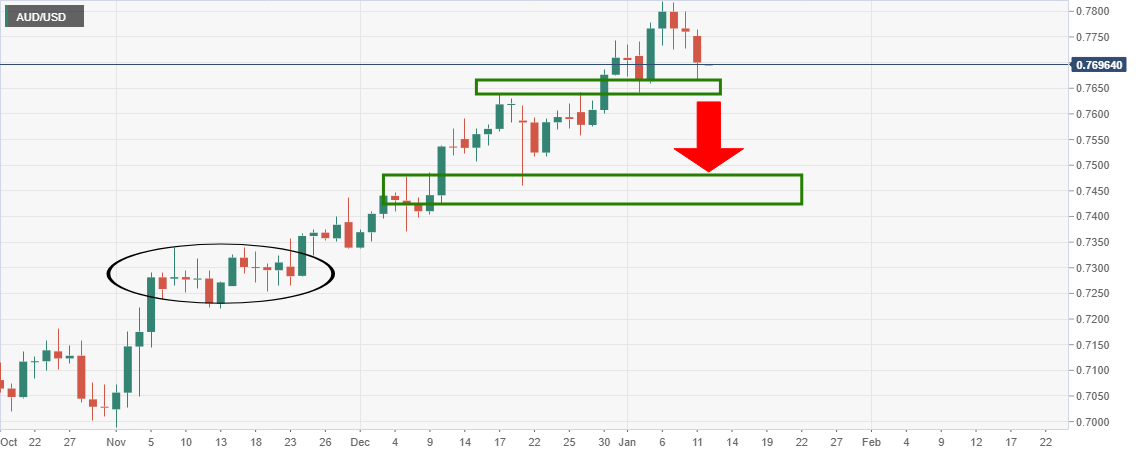

As for the Aussie, the weekly chart us clear as day and is overdue a significant correction.

Bear are on the approach of a test of critical support.

A break below it will open the prospects of a continuation to the weekly targets.