NZD/USD consolidates around 0.7250, still trading as a function of dollar flows

- NZD/USD is consolidating just above the 0.7250 level, lower as a function of the stronger US dollar.

- Amid a lack of any New Zealand specific fundamentals, NZD/USD has traded mostly as a function of dollar flows this week.

NZD/USD has flatlined in recent trade just to the north of the 0.7250 level, having slipped back below 0.7300 early in the European morning. The pair closed Thursday trade with losses of about 0.5% or 34 pips.

Kiwi being driven by USD dynamics

Amid a lack of notable economic or political developments coming out of New Zealand, the kiwi has largely been trading as a function of global themes and US dollar flows. In recent days, rising inflation expectations have been helping lift NZD; rising inflation expectations have gone hand in hand with rising commodity prices that benefit commodity-export dependant economies like that of New Zealand’s.

The pair rallied from the week’s opening levels around 0.7150 to above 0.7300 at one point, its highest level since April 2018, but has since fallen back to 0.7250 amid a broad recovery in the US dollar that has seen the Dollar Index (DXY) recovery back towards 90.00 from weekly (and multi-year) lows in the 89.20s.

Driving the recent dollar recovery has been the Democrat’s Georgia election victory earlier in the week, which handed the party control of Congress to compliment the incoming Biden administration’s rule. Markets are now expecting the Democrats to in Congress to pass significant additional fiscal stimulus in the coming months and the debate as to the long-term impact this will have on the US dollar is raging.

The main bullish arguments go along the lines of further fiscal stimulus boosting US growth in 2021 and beyond leading to higher inflation and a more hawkish Fed. Indeed, the issue of when to start to ween financial markets off of the Fed’s ongoing QE programme already seems a hot topic of discussion amongst Fed members.

Meanwhile, the major bearish arguments are along the lines of more fiscal stimulus leading to higher government and trade deficits and rising bond yields, which put more pressure on the Fed to print money to keep government borrowing costs low.

NZD/USD Technical observations

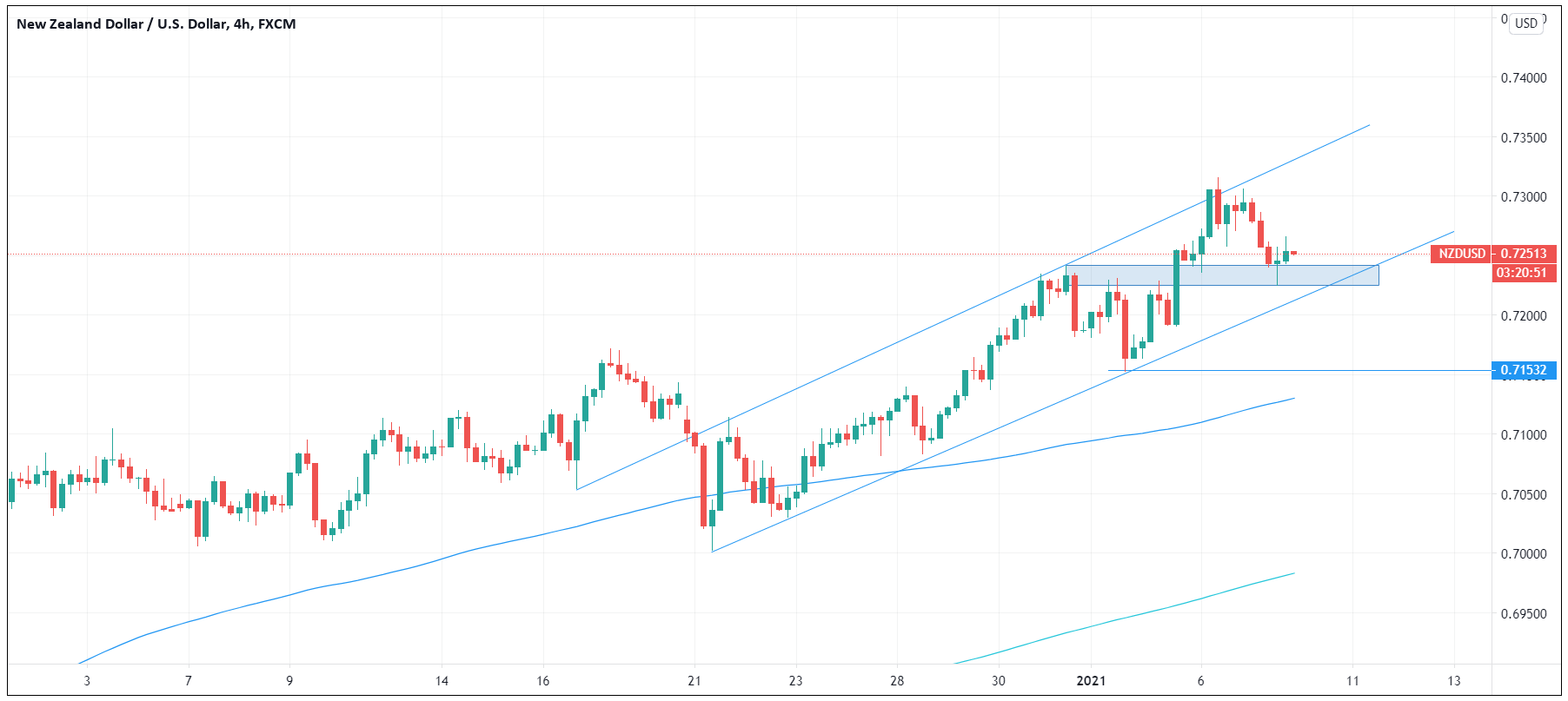

Looking at NZD/USD on a short time horizon; the pair continues to edge to the upside within a trend channel that links the 21, 22 December and 4 January lows. Therefore, its near-term bullish bias remains intact. The pair appears to have found support in support/resistance zone in the 0.7220-0.7240 area.

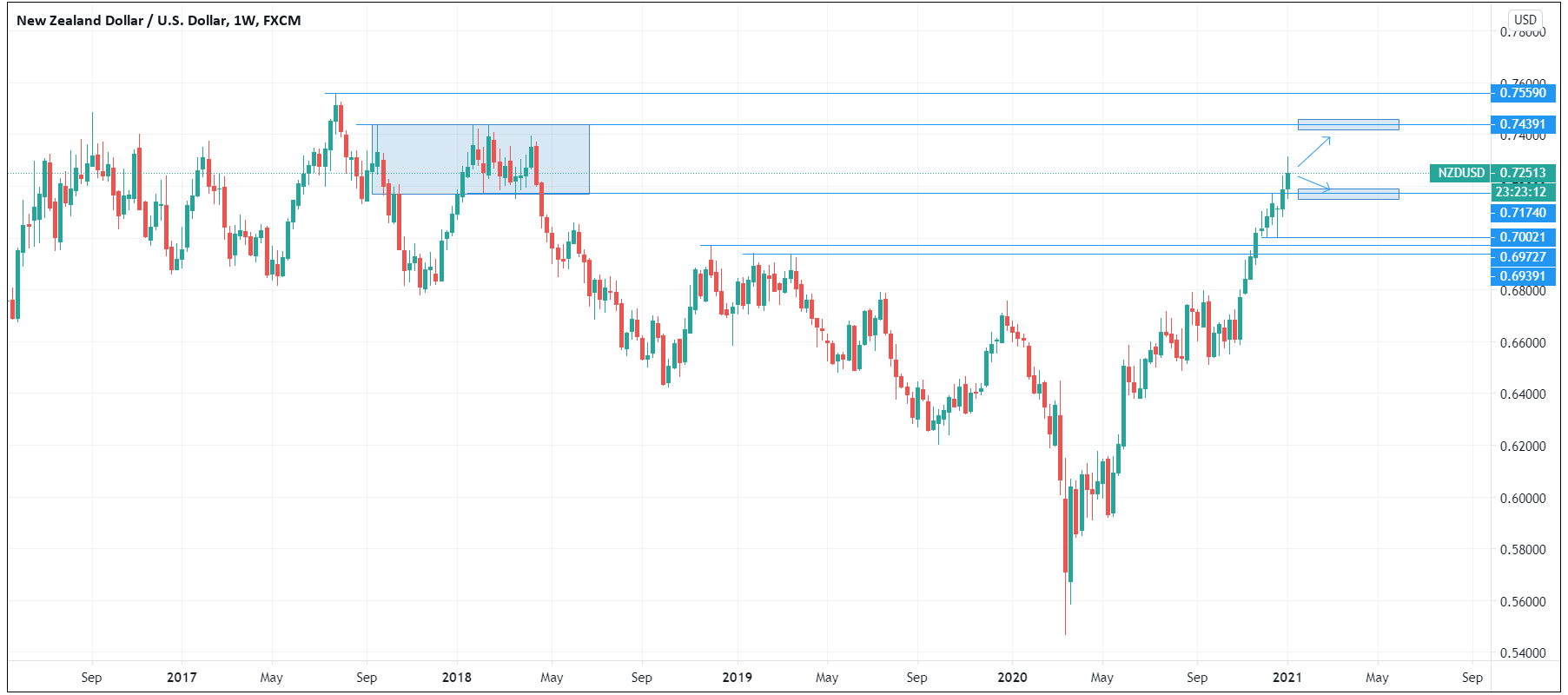

Looking at the pair over a longer time horizon, now that it has broken back into its early 2018 0.7170-0.7440ish range, bulls will be eyeing an eventual move back towards 2018 highs, perhaps coming via a retest of the bottom of this range just under 0.7200.

NZD/USD four hour chart

NZD/USD weekly chart