提供最佳价差和条件

关于平台

关于平台

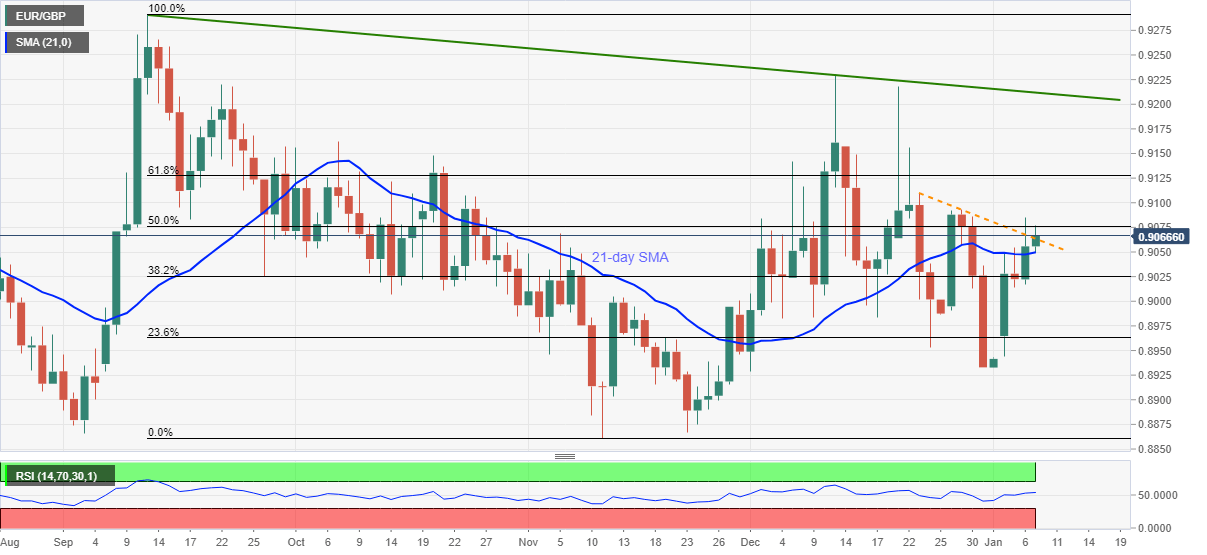

EUR/GBP print mild gains, up 0.13% intraday to 0.9067, during early Thursday. The cross-currency pair broke a descending resistance line from December 23 to regain its stand above 21-day SMA.

With RSI being normal, coupled with an upside break of short-term resistance and SMA, EUR/GBP is likely to extend the recent upward trajectory.

In doing so, 50% Fibonacci retracement of September-November 2020 downside, around 0.9075 becomes the immediate challenge for the quote.

Should EUR/GBP buyers manage to cross 0.9075, 61.8% of Fibonacci retracement and October highs, respectively around 0.9130 and 0.9160, will be on their radars.

Meanwhile, the previous resistance line and 21-day SMA, at 0.9063 and 0.9049 in that order, restricts the pair’s immediate downside ahead of the 0.9000 threshold.

Although EUR/GBP bulls are likely to return around the 0.9000 psychological magnet, any failure to do so will probe the monthly low of 0.8932.

Trend: Further upside expected