Back

17 Mar 2020

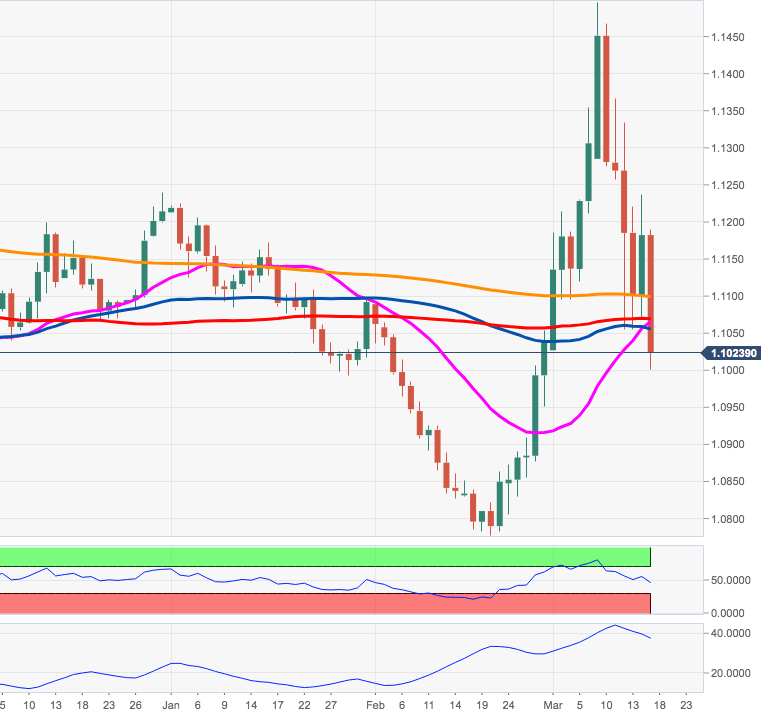

EUR/USD Price Analysis: Rising bets for a move to 1.0992

- EUR/USD regains selling interest and tests the 1.10 mark.

- Immediately on the downside now emerges the 1.0990 region.

The offered bias in the euro has picked up extra steam on Tuesday and forced EUR/USD to come down and re-visit the 1.10 neighbourhood, or new 3-week lows.

While below the 55-day SMA, today at 1.1053, the pair is expected to keep the negative view unchanged.

Against this backdrop, the next support of significance is located at 1.0992 (January’s low) ahead of 1.0981 (November 2019 low).

EUR/USD daily chart