DXY: It may only be a matter of time when US dollars are back by popular demand

- US dollar drops to test the monthly support trendline.

- The Fed is expected to cut to zero, yields through the floor, weighing on the greenback.

- EUR unlikely to maintain a bid, banks are prepared to pay more for USD funding.

The COVID-19 fears have intensified over the weekend as infection rates spread and match-up to worst-case scenarios at the same time that the Federal Reserve recently cut interest rates in an emergency inter-meeting 50 basis-point rate cut.

To top it off, an oil price war sparked off a panic in commodity and financial markets and then the entire US yield curve fell below 1% for the first time in history as investors bet on the Fed cutting to zero and reached for longer-dated securities.

In response, the New York Fed said it will boost the size of this week’s overnight and term repo operations to ensure reserves are ample and reduce the risk of pressures in money markets.

March 17-18 and the April 28-29 meetings are expected to be major events for the dollar where markets are pricing in 50 basis point cuts considering a heavy drop in oil prices which will sap inflation. However, it is worth noting the dramatic short covering in the euro which will have heavily impacted the US dollar as well. There is little reason to believe that the single currency can continue to strengthen in a straight line.

ECB next in line for the market's attention

Ahead of the Fed, we have the European Central Bank this week and markets are looking ahead to the policy meeting to assess what the policy response to the coronavirus crisis in the Eurozone is likely to look like. While a rate cut is unlikely, the ECB would be expected to use its balance sheet as a powerful tool in reducing the strains of the crisis. Considering the Italian crisis and economy, a potential European banking crisis and full out recession int he eurozone, the euro would usually be regarded as an unattractive currency.

When taking into account also the potential fears of a shortage of dollars on the offshore market, just as was seen in the GFC, should markets experience amplified credit risks stemming from corporate debt and tighter monetary conditions, the dollar would come under demand.

"While both the nature of the current crisis and the reforms to the banking sector make direct comparisons with the GFC difficult, the echoes of that emergency are still resonating," analysts at Rabobank argued, noting that, this morning, "dollar cross-currency basis swaps are continuing to widen as they have been since the start of the month."

The analysts argued that "this is signalling that banks are prepared to pay more for USD funding" and "this would suggest that the current softness of the USD could be temporary."

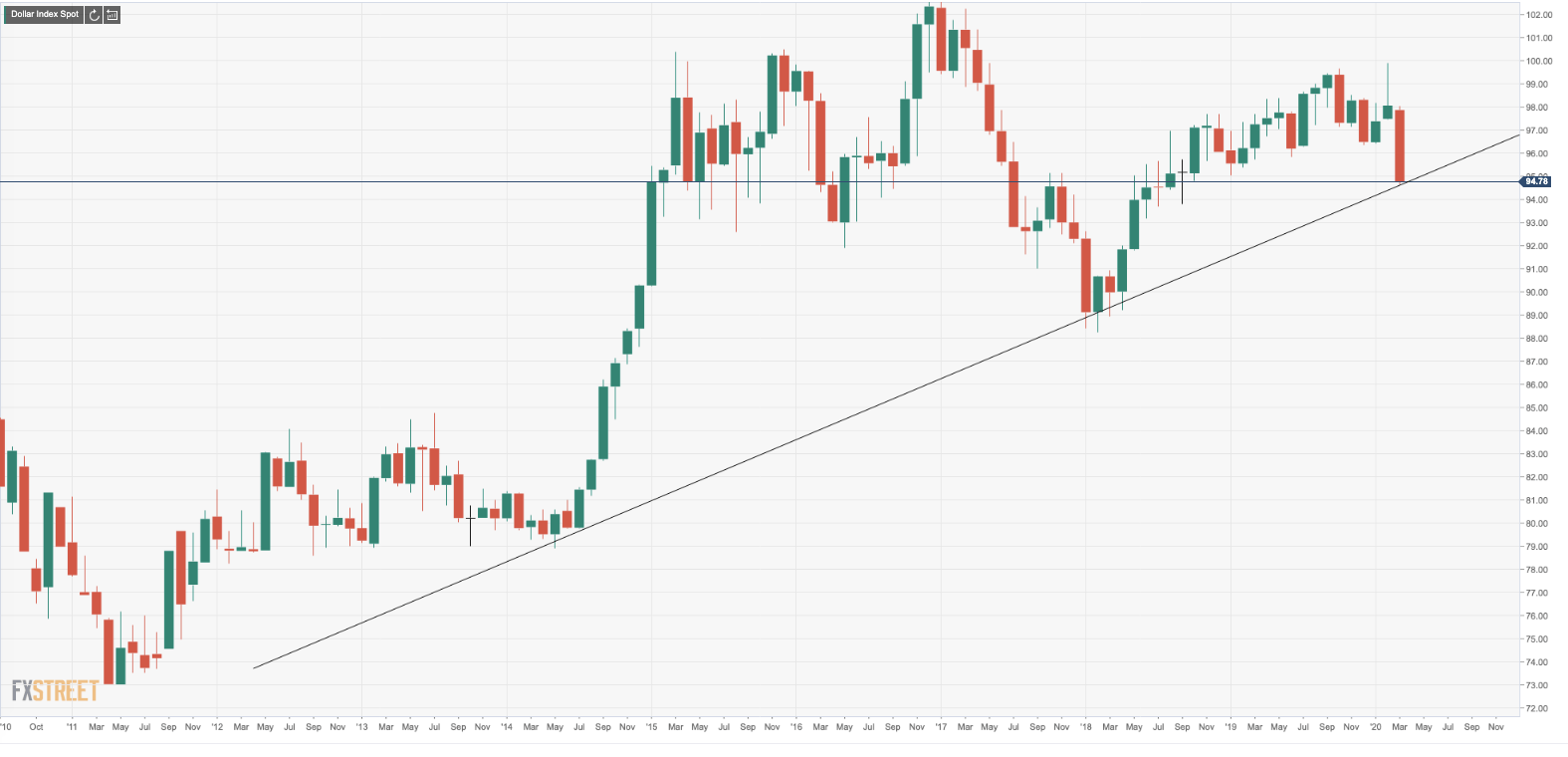

DXY monthly chart

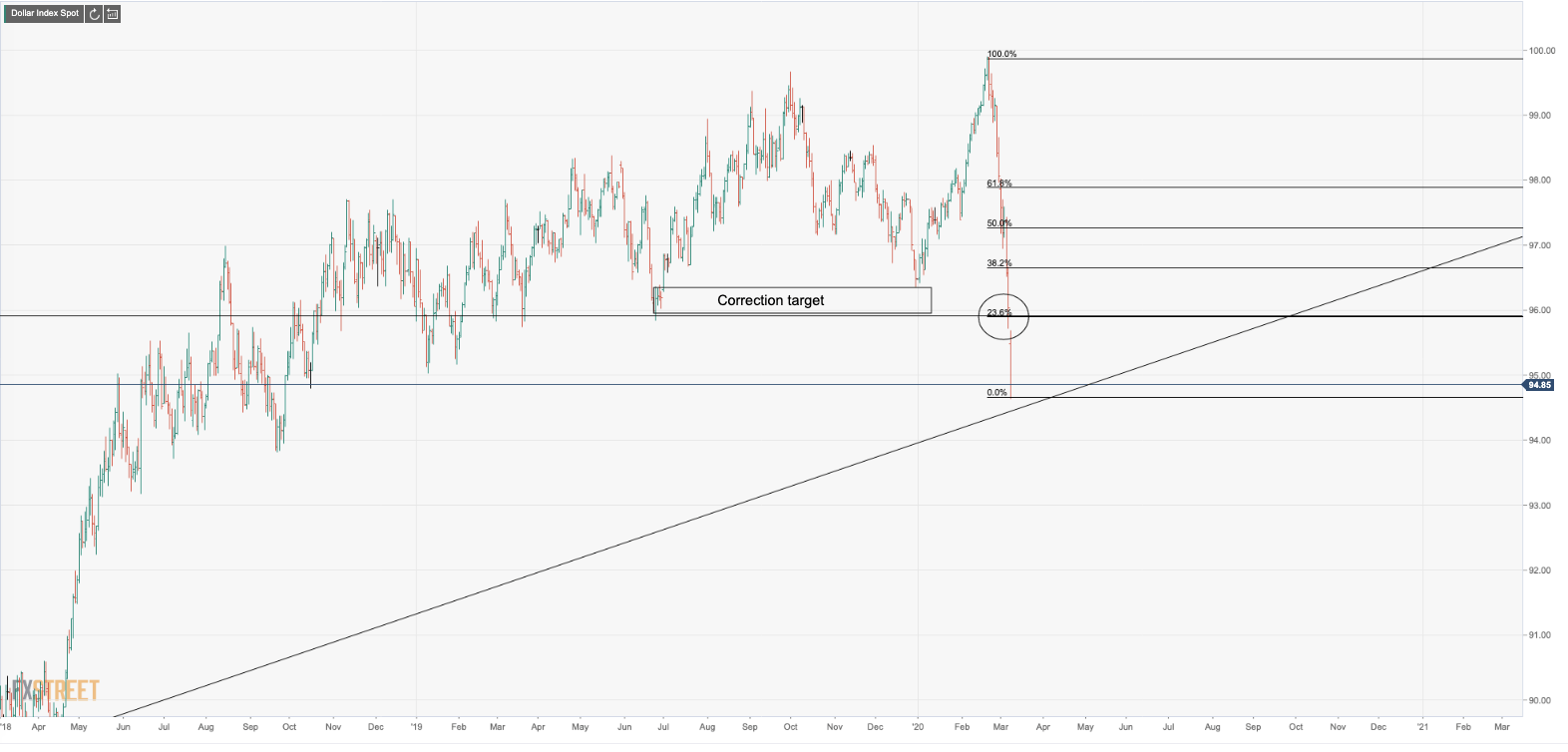

DXY daily chart