WTI trims gains and turns negative below $51.00

- Prices of WTI met resistance above $52.00.

- Broader risk-on mood supported prices initially.

- OPEC+ output cuts remain in centre stage.

Prices of the West Texas Intermediate have extended the rebound from recent 2020 lows, although the bull run lost impetus just above the $52.00 mark per barrel.

WTI looks to OPEC+, risk trends

Crude oil prices have been tracking the upbeat momentum in the rest of the risk-associated assets this past couple of sessions in response to somewhat alleviated concerns around the Wuhan coronavirus, particularly after news cited that scientists could be working on a drug to counteract the virus and Chinese government ramped up efforts in order to contain the spread of the virus.

In addition, increasing speculations that the OPEC+ could extend the ongoing output cut deal and deepen the cuts have been also behind the moderate rebound from lows in the $49.30 region recorded on Tuesday.

However, Russia’s A.Novak poured cold water over the increasing optimism among traders after he stressed that the country needs more time in order to assess the likeliness of deeper cuts after the 3-day emergency meeting finished in Vienna earlier on Thursday.

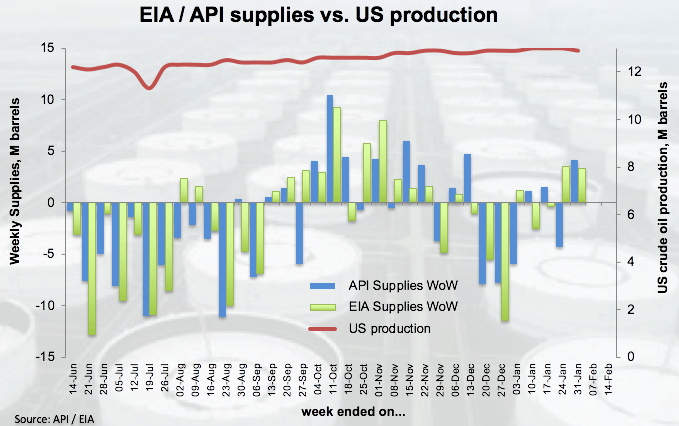

Also adding to the now downbeat mood around crude oil, the EIA reported on Wednesday a nearly 3.4 million barrel build in US crude oil supplies during last week. These figures add to the API’s reported build of almost 4.2 million barrel late on Tuesday.

What to look for around WTI

Diminishing concerns over the Chinese coronavirus have been sustaining the improved sentiment in crude oil prices, motivating the barrel of WTI to regain nearly $3 since Tuesday’s 2020 lows. Traders, in the meantime, continue to look to the developments from the OPEC+ emergency meetings with the potential extension of the current output cut agreement and deeper cuts (around 600K barrels) on top of the agenda. Further attention stays on oversupply jitters and the predicted slowdown of crude oil demand in response to the virus outbreak.

WTI significant levels

At the moment the barrel of WTI is retreating 0.72% at $50.83 and a breach of $49.31 (2020 low Feb.5) would aim for $42.20 (2018 low Dec.24) and finally $41.83 (2017 low Jun.21). On the upside, the next hurdle is expected to emerge at $52.18 (weekly high Feb.6) seconded by $54.35 (weekly high Jan.29) and then $56.90 (200-day SMA).