Back

8 Jan 2020

JPY Futures: further appreciation looks likely

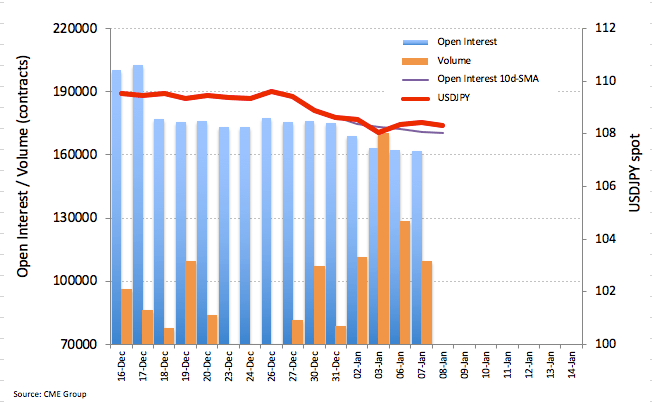

Open interest in JPY futures markets shrunk by just 267 contracts on Tuesday according to flash data from CME Group. Volume, too, went down for the second session in a row, now by nearly 19.2K contracts.

USD/JPY upside appears capped by 108.60

The recent move up in USD/JPY was on the back of declining open interest and volume in the Japanese safe haven, noting the presence of short covering behind the climb. The yen is expected to remain sensitive to risk events – particularly on the US-Iran conflict – and therefore further appreciation should not be ruled out for the time being. In the meantime, the upside looks so far capped by the key 200-day SMA in the 108.60/65 band.