AUD/USD bulls nearing 0.7900 as US CPI came in line

- CPI Ex Food & Energy y/y for February came in line at 1.8%.

- US Dollar (DXY) plunges below 90.

The AUD/USD is trading at around 0.7881, up 0.12% on the day.

The main event of the day is most certainly the inflation data coming from the US. Consumer Price Index Ex Food & Energy y/y for February which came in line at 1.8%. The headline CPI increased 0.2% m/m in February. CPI breakdown here.

The Fed plans to hike three times in 2018. Powell said that four rates hike are possible but after the last NFP, the average hourly earnings decelerated from 2.9% to 2.6% the DXY took a hit as the market started to doubt. It is worth mentioning that last month the market started to price in four rate hikes after higher than expected US inflation numbers which accelerated 0.5% m/m in January.

However, this month the market seem to be disappointed as the US Dollar is being sold across the board losing value against most major currencies as the US Dollar Index is trading below 90.

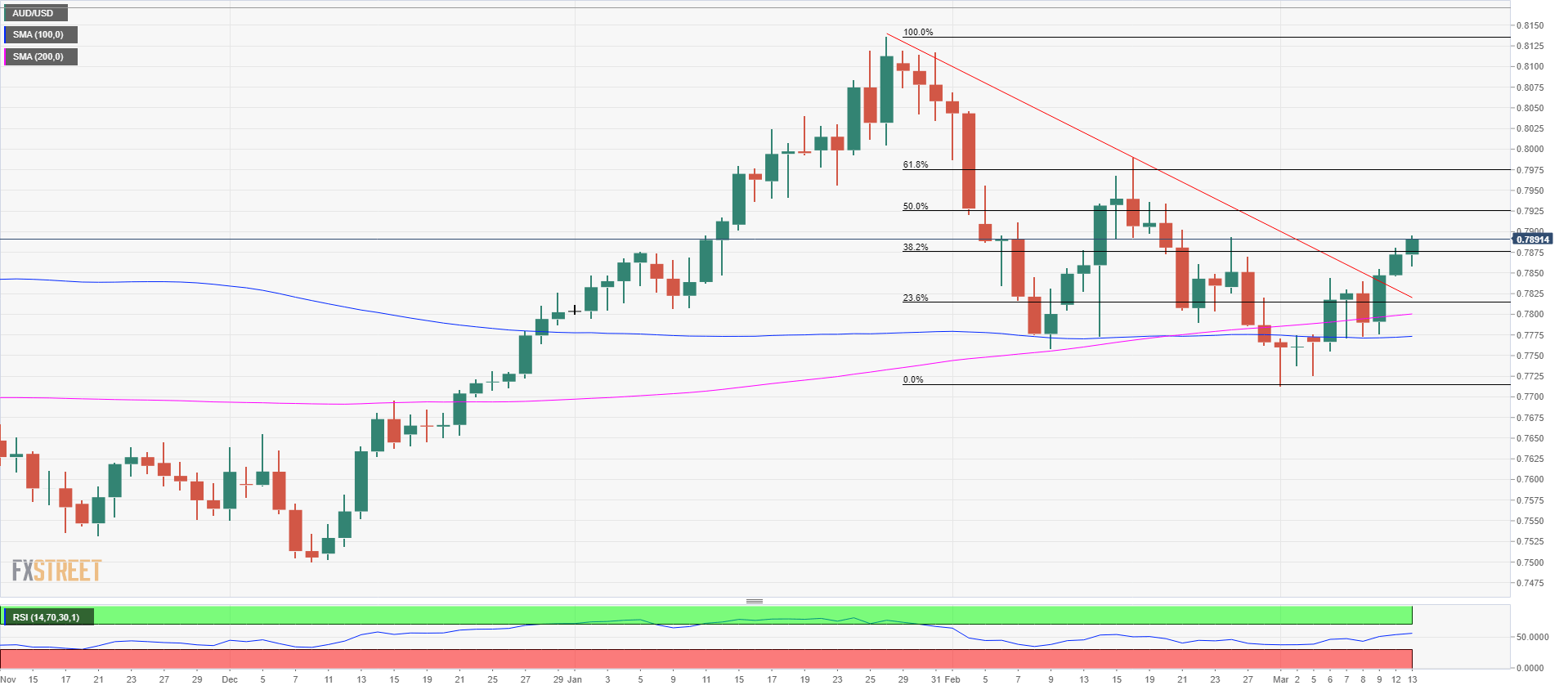

AUD/USD daily chart:

The AUD/USD broke above a major descending trendline as shown on the chart above (red line). The next support is seen at 0.7925 which is the 50% Fibonacci retracement level from the late January-March down move. The next key resistance is seen at the 61.% Fibonacci retracement from the same move, at 0.7975. Support is seen at 0.7875 which is the 38.2% Fibonacci retracement and close to today’s open. Further down, the 0.7825 level should provide support with the 23.6% Fibonacci retracement.