提供最佳价差和条件

关于平台

关于平台

UK Jobs report overview

UK labor market report is expected to show that the number of people seeking jobless benefits climbed by 1.0k in the three months to January, compared to a decrease of 10.1k booked in the three months to December.

The unemployment rate is expected to remain unchanged at 4.8% during the period. Average weekly earnings, including bonuses, in the three months to Dec are expected to show no growth from the previous 2.8% increase. While ex-bonuses also the wages are expected to stay flat at 2.7%.

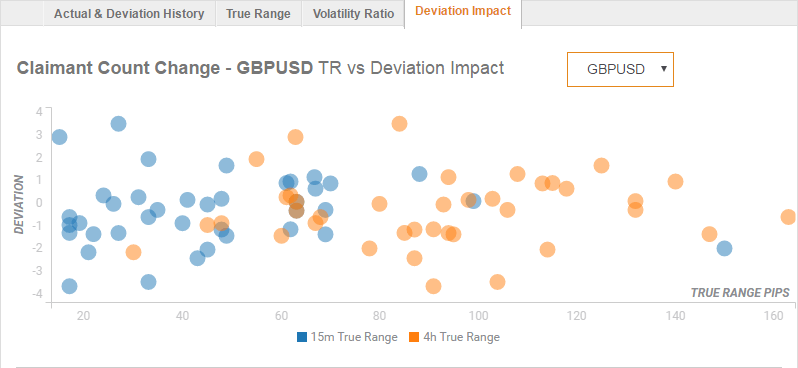

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 20 and 60 pips in deviations up to 2 to -4, although in some cases, if notable enough, a deviation can fuel movements of up to 85 pips.

How could affect GBP/USD?

Upbeat clamant count and wage price-growth numbers could rescue the GBP bulls from Yellen-led declines. Hence, the cable could witness a recovery towards 1.25 handle. On the flip side, should the data disappoint, we could see the GBP/USD pair breaching post Yellen lows of 1.2445 and head towards next support at 1.2400 levels.

Key notes

UK jobs preview: Headline wage growth to hold steady at 2.8% - TDS

“We’re in line with consensus for today’s labour market data in looking for the unemployment rate to remain unchanged at 4.8% and for headline wage growth to hold steady at 2.8%, both for the month of December.”

About UK jobs

The Claimant Change released by the National Statistics presents the number of unemployment people in the UK. There is a tendency to influence the GBP volatility. Generally speaking, a rise in this indicator has negative implications for consumer spending which discourage economic growth. Generally, a high reading is seen as negative (or bearish) for the GBP, while a low reading is seen as positive (or bullish).