Back

15 Mar 2023

Crude Oil Futures: A corrective bounce appears on the cards

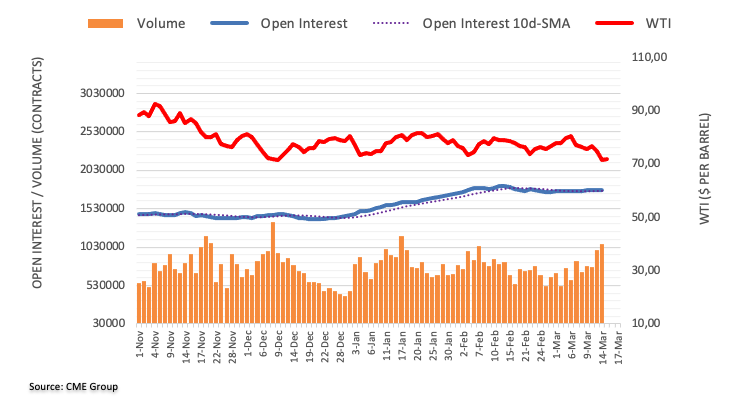

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions by around 3.7K contracts on Tuesday, leaving behind five consecutive daily builds. Volume, instead, increased for the second session in a row, this time by around 73.1K contracts.

WTI risks a drop to $70.00

Prices of the barrel of the WTI dropped markedly and printed new 2023 lows near $70.80 on Tuesday. The acute pullback, however, was on the back of dwindling open interest and opens the door to a probable rebound in the very near term. The bearish view in the commodity maintains a potential drop to the $70.00 mark for the time being.