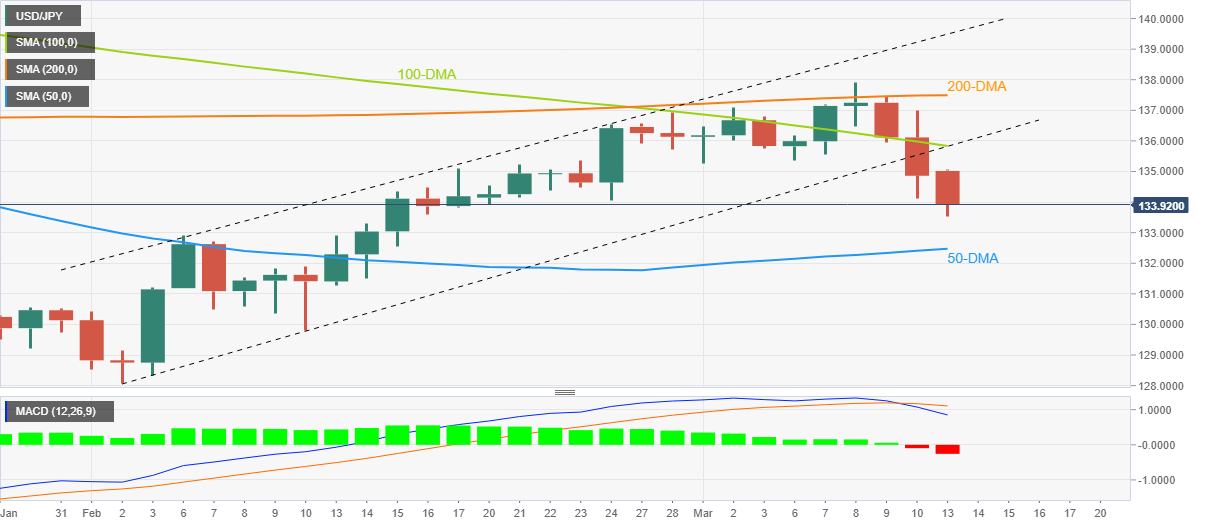

USD/JPY Price Analysis: Yen renews one-month low near 134.00 as bears approach 50-DMA

- USD/JPY holds lower ground after refreshing a one-month bottom.

- U-turn from the DMAs, rejection of bullish channel and the strongest bearish MACD signals since early February to favor sellers.

- Early February tops may test Yen pair bears ahead of 50-SMA.

- Buyers remain off the table unless witnessing a clear break of 200-DMA.

USD/JPY bears keep the reins for the third consecutive day heading into Monday’s European session. In doing so, the Yen pair seesaws around the lowest levels in one month, marked earlier in the day, as sellers poke the 134.00 threshold.

A clear U-turn from the 200-DMA, as well as a downside break of the 100-DMA, joins a sustained downside break of a five-week-old bullish channel to favor USD/JPY sellers. On the same line could be the strongest bearish MACD signals since early December 2022.

With this, the Yen pair appears all set to slump toward the 50-DMA support of 132.50. However, the early February swing highs near 132.90 seem to prod the USD/JPY sellers of late.

In a case where the USD/JPY price remains bearish past the 50-DMA, the 130.00 round figure and the previous monthly low surrounding 128.00 will be in the spotlight.

On the flip side, a convergence of the 100-DMA and the aforementioned channel’s lower line, close to 135.85, holds the key to USD/JPY pair’s recovery.

Even so, the 200-DMA can test the upside momentum near 137.50 before directing prices towards the aforementioned channel’s top line, close to 139.50 at the latest.

USD/JPY: Daily chart

Trend: Further downside expected