AUD/USD Price Analysis: H1 M-formation holds the bears hostage for the open

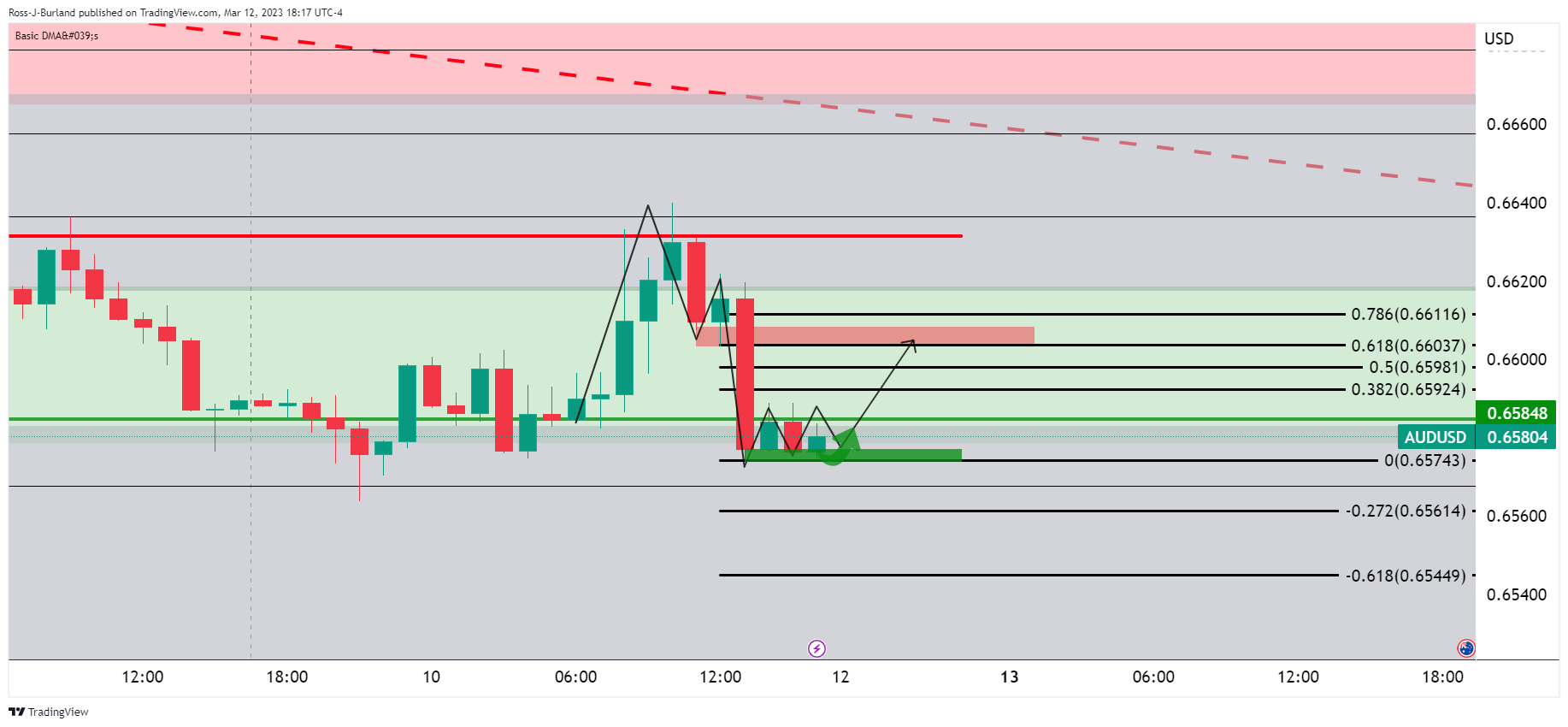

- AUD/USD´s H1 M-formation, a reversion pattern, holds 0.6600 as a target for the open.

- AUD/USD bears need to get below a consolidative pattern and support near 0.6570.

As per the prior analysis and before the Nonfarm Payrolls event on Friday that sent the US Dollar substantially lower, AUD-USD remains in the realms of a geometrical bearish formation:

AUD/USD prior analysis

It was stated that the price was carving out a geometrical box, an ascending triangle, in a downtrend which is considered a bearish chart pattern.

´´Two-way price action can be expected from here with a bearish bias while on the front-side of the bear trend and below the 200 DMA,´´ the analysis stated with 0.6520 being key in this regard as it guarded a move towards 0.6380.

AUD/USD update

The triangle formation has morphed into a sideways consolidation. Of note, an M-formation has formed on this hourly chart:

The M-formation is a reversion pattern and the price can be pulled into the neckline for a restest which is yet to play out, so far. However, it is worth noting for the open this week with 0.6600 being a key level in this regard.