提供最佳价差和条件

关于平台

关于平台

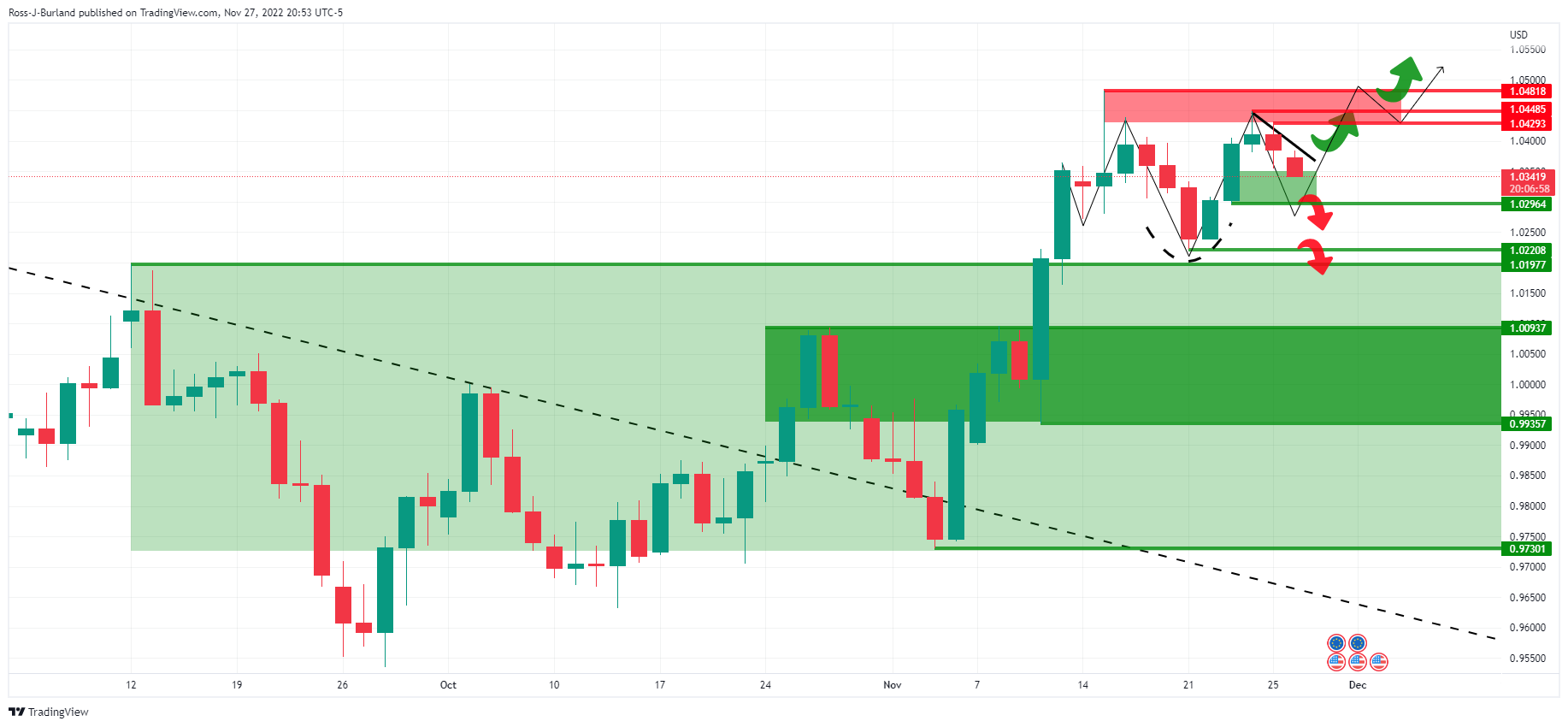

EUR/USD bears have moved in on the risk of the Chinese Communist Party losing power as protesters angered by strict anti-virus measures called for China’s powerful leader to resign. Markets have opened risk-off which is supporting the US Dollar, weighing on the euro as the following technical analysis illustrates:

While below 1.0480, the bias is for a downside correction into the support structure. A 50% mean reversion comes in near 1.0050.

With that being said, an inverse head & shoulders could be in the making at this juncture. Bullish commitments around 1.0300/50 would be forming the right-hand shoulder of the bullish pattern.

The bears will be back in control on a break of 1.0220.

The bulls need to hold 1.0350 and get on the back side of the micro bearish trendline resistance on the 4-hour chart or face risks of a break below 1.0300.