Back

27 Nov 2022

AUD/USD Price Analysis: Bulls could be tested at 0.6750 resistance

- AUD/USD bulls meeting M-formation neckline resistance.

- The bulls need to commit at the 0.6700 area if there is to be a retest to the downside.

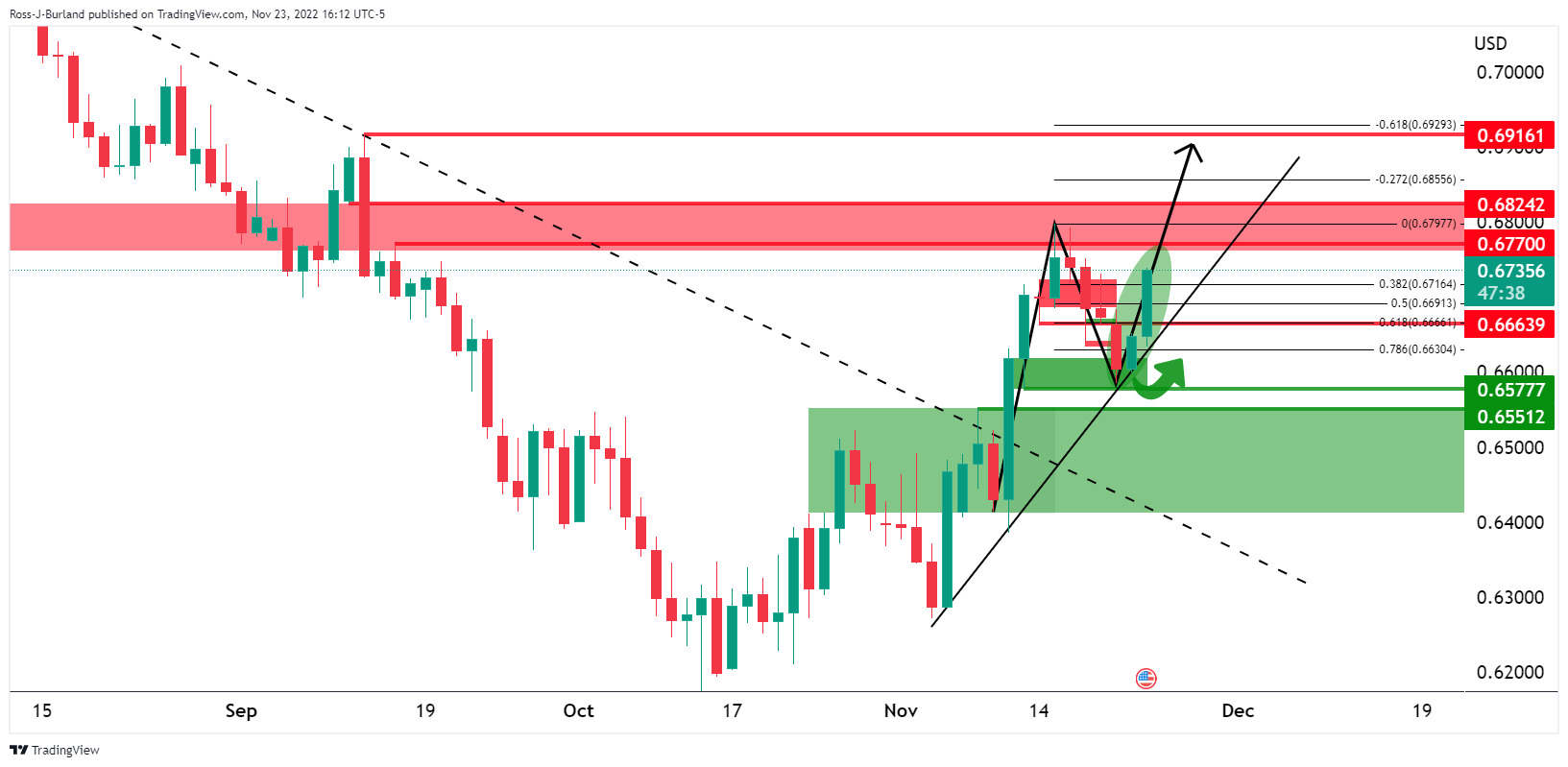

As per the prior analysis, AUD/USD Price Analysis: Bulls eye 0.6900s into year-end, the bias remains to the upside for the week ahead while being on the front side of the bullish trendline. AUD/USD reached a high of 0.6778 but has so far failed to break resistance.

The following illustrates the bias for a move towards 0.6900 for an onward bullish cycle for the rest of the year.

AUD/USD prior analysis

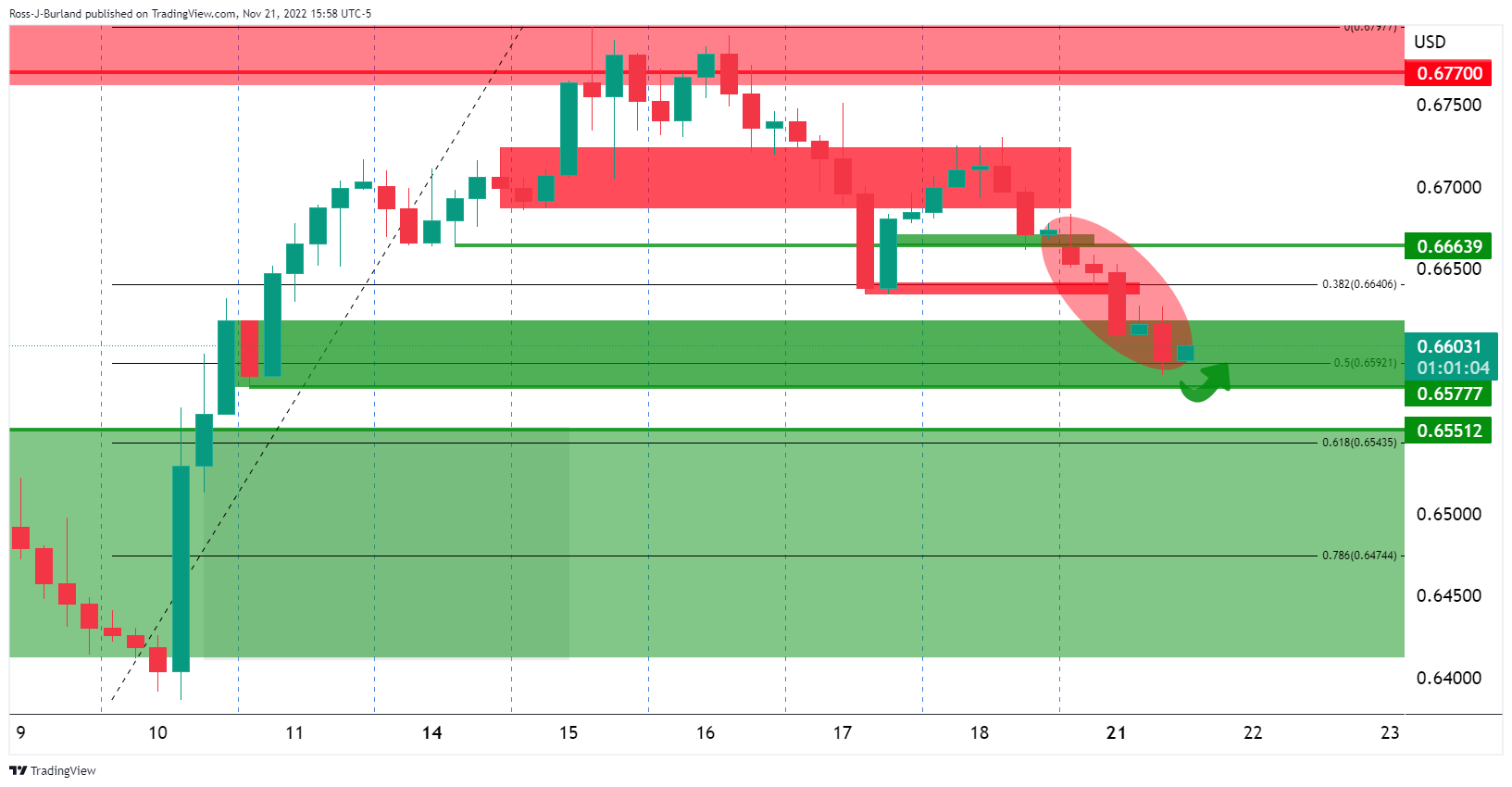

The four-hour chart showed the price meeting the 50% mean reversion of the following daily chart's prior bullish impulse:

AUD/USD remains on the front side of the daily trendline with the 0.6900s eyed:

AUD/USD H4 chart

The bulls need to commit at the 0.6700 area if there is to be a retest to the downside following failures at 4-hour resistance near the neckline of the M-formation.