提供最佳价差和条件

关于平台

关于平台

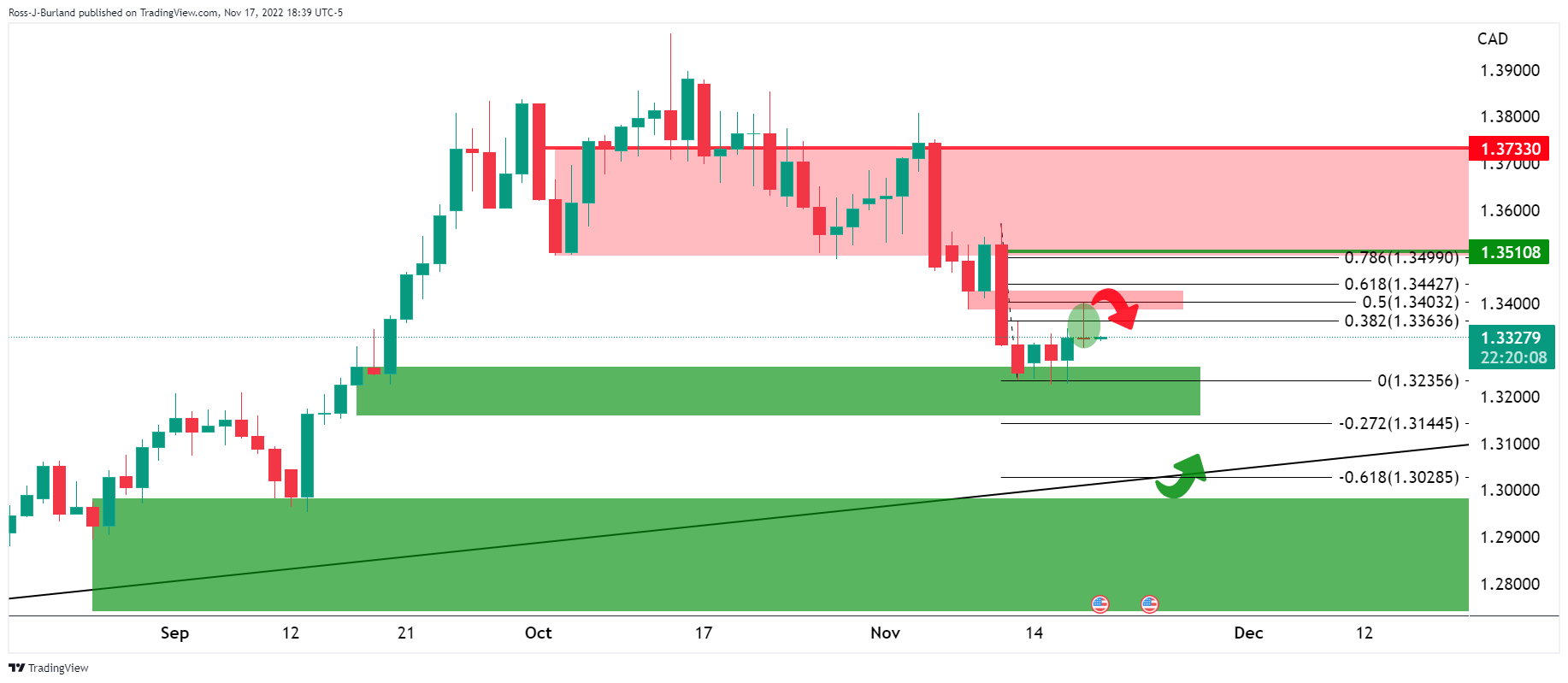

As per the prior day's bullish thesis, USDCAD Price Analysis: Bulls moving in and eye a 38.2% Fibo, the price indeed moved in on the targetted area. However, the bears were quick to pounce on the rally and we are back to square one as the following illustrates:

it was explained that the Bank of Canada next meets on December 7 and a 25 bp hike to 4.0% is expected and that there is a long time between now and then that gave rise to prospects of a meanwhile correction as follows:

The M-Formation was a compelling bullish feature, but it was also explained that there could still be some downside to come:

A break of the support was eyed as a catalyst that would open up the way to dynamic trendline support.

However, the bulls were firming and the 38.2% Fibonacci was eyed for the remainder of the week:

We have seen that move already. Until a break of 1.33 the figure, the emphasis remains on the upside as per the hourly chart:

The M-formation is a reversion pattern and so long as the bulls can get above 1.3380 and then 1.3420, there will be prospects of a move into the price imbalance and 1.3550 will be vulnerable.