AUD/USD oscillates around 0.6260s on mixed US data, post-Fed hawkish commentary

- AUD/USD is registering minimal gains amidst a risk-on impulse.

- Fed officials to keep increasing rates, amidst mixed US economic data reported.

- Australia’s employment figures justified the RBA’s ¼ increase to the OCR.

The AUD/USD advances in the North American session, though below its daily high reached at the London fix, of 0.6356, amid the Fed’s hawkish commentary and a risk-on impulse, which kept the greenback pressured, as shown by the US Dollar Index (DXY). At the time of writing, the AUD/USD is trading at 0.6276, up 0.13%.

On Thursday. Fed officials continue to express worries about high inflation in the US. Given the scenario of CPI hitting 8% in September and the tightness of the labor market, Philadelphia’s Fed Patrick Harker and Fed board member Lisa Cook commented that the Fed would need to keep increasing rates. Harker commented that he is “disappointed of the lack of progress curtailing inflation,” while he added that he expects rates to be above 4% in 2023.

Aside from this, a tranche of US economic data gave mixed signals to market participants, given that the Fed has hiked 300 bps in the year. The US Department of Labor reported that last week’s claims for unemployment rose by just 214K, less than estimates, reflecting the labor market resilience. In the meantime, US Existing Home Sales slid for the eighth consecutive month, as higher mortgage rates, around 7% sparked by the Federal Reserve’s monetary stance, had cooled down the housing market.

Aside from this, Australia’s job data in September disappointed, as the economy added just 900 workers to the economy, well below the 25K estimated, and trailed the August jump of 36K. Australia’s jobs data miss justified the Reserve Bank of Australia’s (RBA) minuscule rate hike early in October as the bank slowed its tightening pace. In the same report, the Unemployment Rate stood steady at 3.5%.

Given that backdrop, the Federal Reserve tightening cycle will leave the greenback on the front foot against the Australian dollar. Money market futures expect the Federal funds rate (FFR) to peak around 5%, while the RBA Overnight Cash Rate (OCR) will hit 4%. Therefore, the interest rate differential, and the safe-haven status of the US Dollar, will keep the AUD/USD downward pressured.

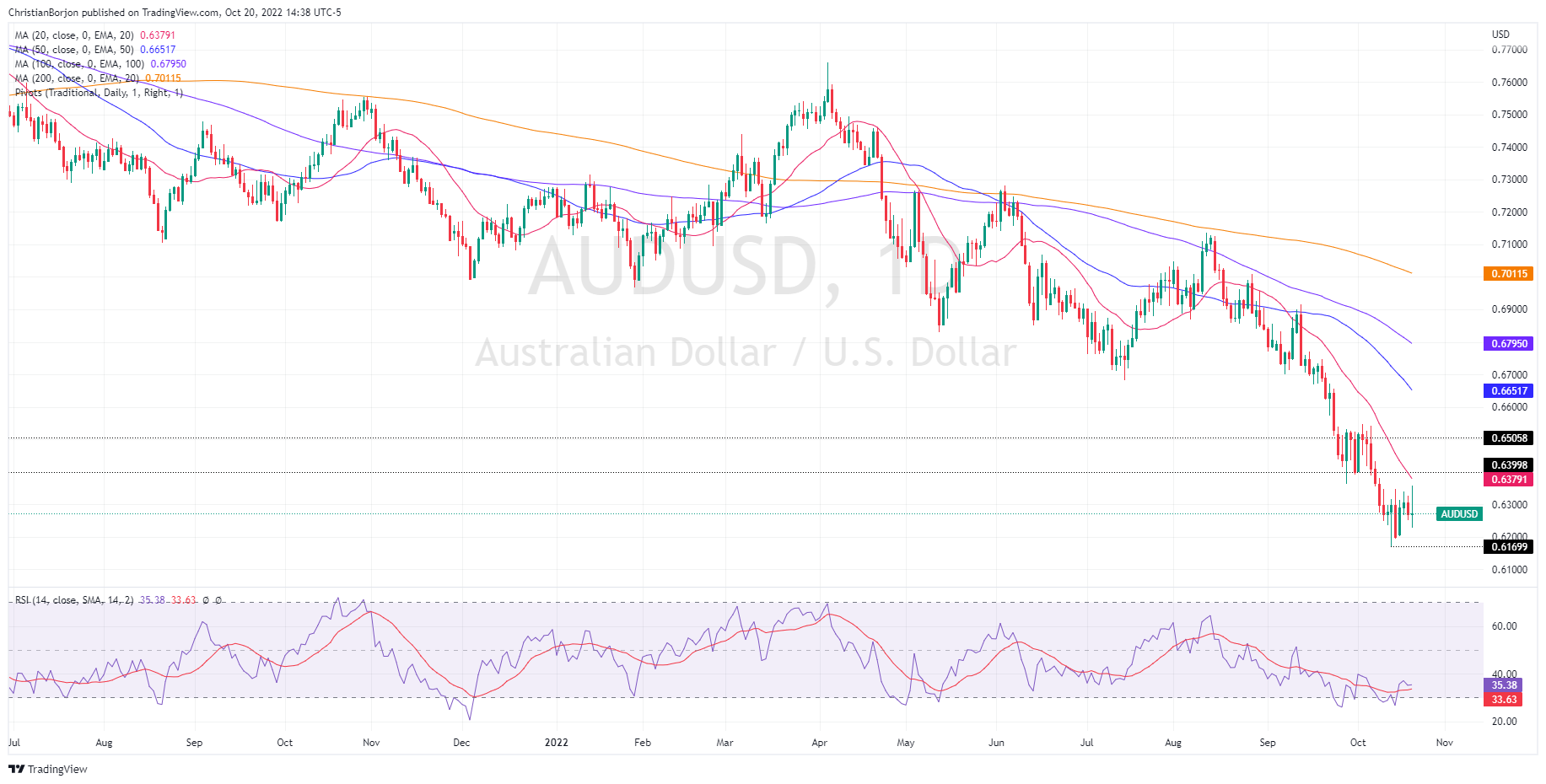

AUD/USD Price Forecast

The AUD/USD downtrend remains intact, despite jumping off the daily lows. Worth noting that the AUD/USD registered fresh weekly highs around 0.6356, but Fed hawkish commentary, and elevated US bond yields, were headwinds for the AUD/USD. However, with the Relative Strength Index (RSI) reaching higher lows, contrarily to AUD/USD’s price action, a positive divergence surfaced, the spark for the earlier gains. Unless buyers keep the major from registering a negative day, a re-test of the 0.6300 figure is on the cards.